Four things you need to know about Life Insurance

-

If a loved one counts on you for

financial support, you most likely need life insurance.

-

Even if you have a group coverage

from your employer, it may not be enough to protect your

family and may terminate when you leave the company.

-

Replace your annual income

-

Cover your family’s living

expenses

-

Cover education costs

-

Cover your funeral expenses

-

Cover final income taxes

-

Coverage lasts a lifetime

-

Permanent Life Insurance meets a

variety of needs, including creating an estate,

covering taxes on an estate, providing for a child

with special needs

-

Age, weight, Height, Health Status, Medical history and other factors

Protect Your Family with Life Insurance

Don’t Delay - if you are like many busy parents you’ve got important things on your to-do list that never get checked off. Two most common items are making a will land purchasing life insurance.

By not acting you may cause severe hardship-stress for your family.

-

If you pass away without a will the provincial court determines who gets what from your estate assets. It may not be the distribution you wanted.

-

The court will appoint someone to administer your estate. Not only could this cause delays, but it may increase administration costs, leaving less for your heirs.

-

Think of the consequences if you should pass away without life insurance. Your family’s standard of living would suffer. They may need to leave the family home. Your spouse may not have enough for your child’s post-secondary education.

-

Also keep in mind any money you owe is taken from your estate assets, possibly depleting your legacy.

Is Mortgage Life Insurance Your Best Choice?

-

An alternative to mortgage insurance is to simply purchase life insurance and choose an amount that covers your mortgage.

Benefits Include:

- You own the policy

- You name the beneficiary

- The death benefit does not decrease

- The coverage stays with you no matter where the mortgage is

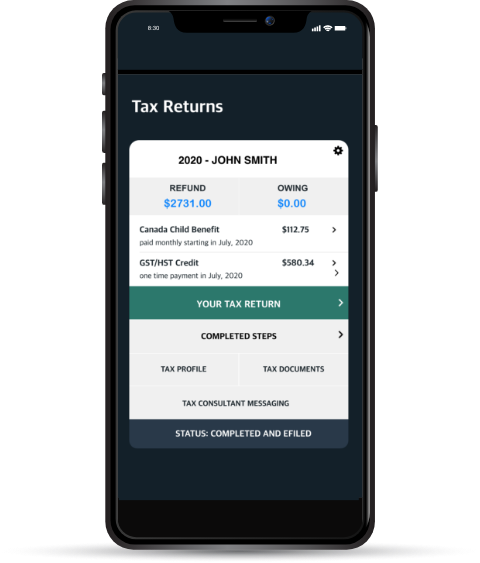

Hello my fellow Canadians. I would like to take this opportunity to introduce myself. My name is Victoria

Paquette, an enthusiastic and friendly professional with a passion for helping others and building

positive relationships. I provide my clients with a holistic approach in personal and small business

tax planning, filing, life insurance needs, investment planning and many areas of financial planning

services.

Hello my fellow Canadians. I would like to take this opportunity to introduce myself. My name is Victoria

Paquette, an enthusiastic and friendly professional with a passion for helping others and building

positive relationships. I provide my clients with a holistic approach in personal and small business

tax planning, filing, life insurance needs, investment planning and many areas of financial planning

services.